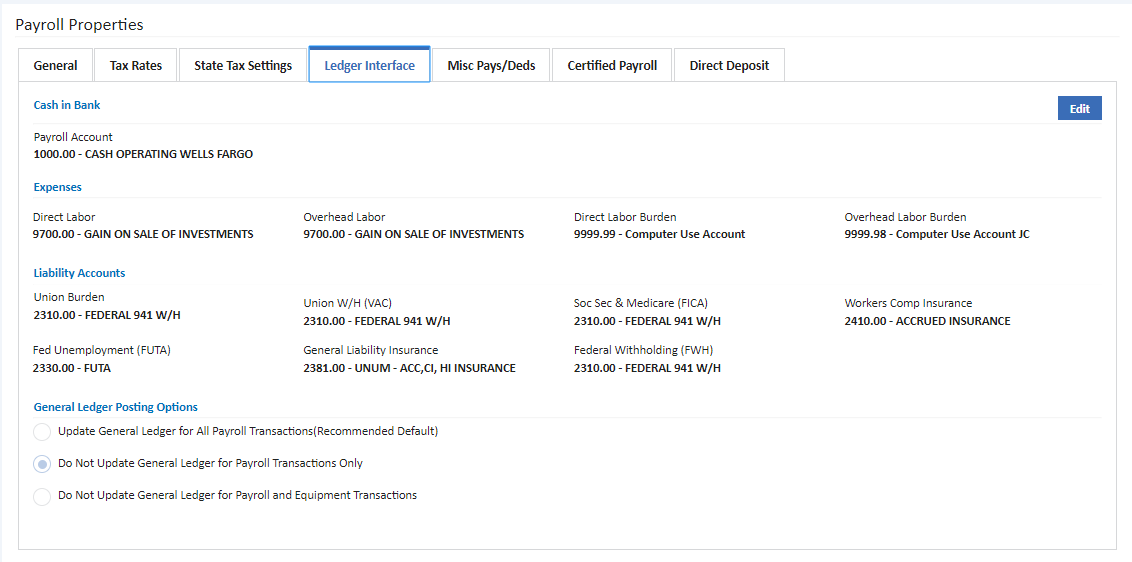

If the Ledger system has been included with the accounting package, then the user must update all of the associated general ledger accounts that tie in or interface with the payroll system. These accounts control how the payroll information is spread to the general ledger when checks are processed through the system. The account numbers must exist in the Chart of Accounts before they can be selected from the drop-down lists.

Cash in Bank

Payroll Account - This field will be used for the net amount of the payroll checks whenever checks are processed through the payroll system. This amount will normally be a credit ('CR') to the account for the net amount of all the payroll checks being processed. The only time that this amount would be a debit ('DR') is when a payroll check is voided out of the system.

Expenses - The following default expense accounts will only be applicable for timecard entries that are entered without a department code. Timecard entries can consist of a combination of entries that exclude or include department codes. Department codes are used primarily to set up a more detailed interface to the general ledger system. Whenever a payroll check is spread through the accounting system, the general ledger will be updated based on the accounts associated with each department code or based on the following default accounts if department codes are not used. Amounts charged to these accounts will normally post with a debit entry.

- Direct Labor - Labor that is charged to a job are called direct labor. The gross pay portion of the direct labor entry will be charged to this account if the department code is zero.

- Direct Labor Burden - The employer's labor burden expense will be posted to this account for labor that is entered with a department code of zero and is charged to a job. The burden amount will include all of the taxes, insurance, and union expenses that are paid by the employer. The burden amount will vary with each payroll transaction, depending on whether workers comp codes or union codes are entered with the transaction.

- Overhead Labor - Labor that is NOT charged to a job is called overhead labor. The gross pay portion of the overhead labor entry will be charged to this account if the department code is zero.

- Overhead Labor Burden - The employer's labor burden expense will be posted to this account for labor that is entered with a department code of zero and is NOT charged to a job. The burden amount will include all the taxes, insurance, and union expenses that are paid by the employer. The burden amount will vary with each payroll transaction, depending on whether workers comp or union codes are entered with the transaction.

Liability Accounts - These accounts are used to hold the accrued liability amounts of the payroll taxes, union benefits, and workers compensation and general liability insurance. Amounts charged to these accounts will normally post with a credit entry. Any amount that is part of the employer's burden will also debit the labor burden account as dictated by the timecard entry.

- Union Burden - This account will accumulate the employer's portion of the union payable amounts. These amounts, which are paid directly to the union, include such items as pension funds, health and welfare, apprentice training programs etc. This field may be left blank if your company is non-union.

- Workers Comp Insurance - For each timecard entry that is linked to a workers comp code, the system will calculate a liability amount that will credit the account listed in this field. When the workers comp code is entered during the timecard process, the system will calculate the liability expense by multiplying the liability rate by the gross pay amount. Overtime earnings will be converted to straight time earnings before calculating the accrual amount.

- General Liability Insurance - If the company's general liability insurance is based on gross payroll wages, a general liability rate may be set up in association with a workers comp rate. The calculated liability amount will credit the account listed in this field.

- Soc Sec & Medicare (FICA) - This account will hold the total of all of the withheld FICA taxes along with the FICA burden taxes that are paid by the employer.

- Fed Unemployment (FUTA) - This account will hold the total of all of the federal unemployment tax payable that the employer pays on top of the gross wages.

- Fed Withholding (FWH) - This account will accumulate all of the federal income taxes withheld from the employees' checks.

- Union W/H (Vac) - If the union vacation pay is paid to the employee and then withheld from the employee's check, then the withheld amount will be posted to this account. The withheld amount will then be paid to the union by the employer. This field may be left blank if your company is non-union.

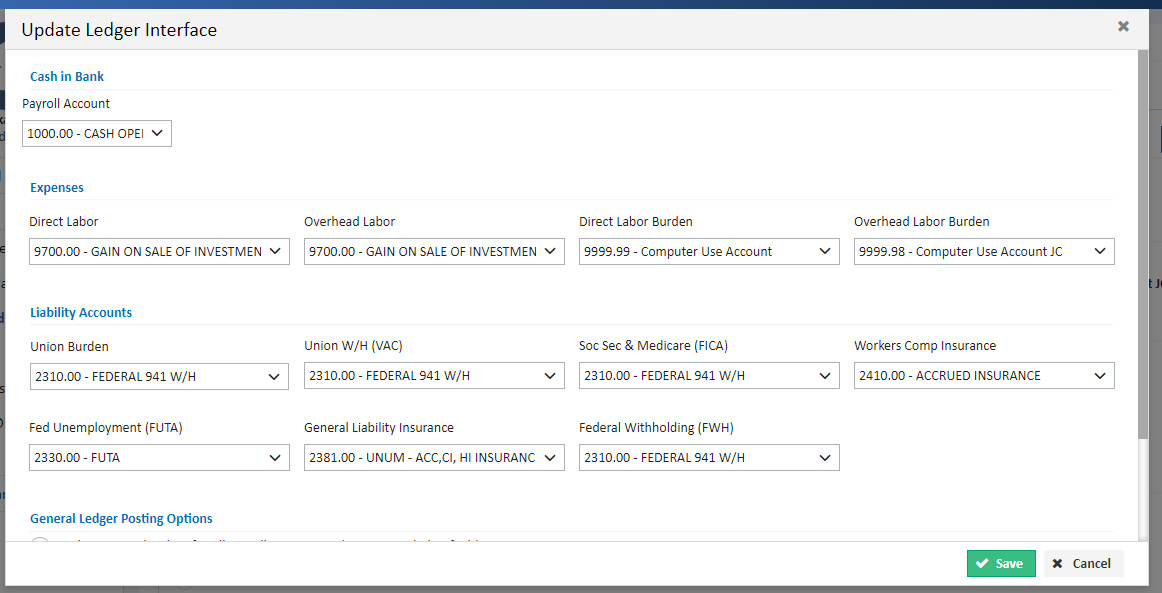

General Ledger Posting Options - Once the payroll is submitted the general ledger posting will be updates depending on the option selected under general ledger posting options in the below screen. On clicking the Edit button, the values for each field can be changed in the Update Ledger Interface screen.

Click Here to download User Guide

Click Here to download User Guide